A Consumer Proposal filed by two or more people is called a Joint Proposal and in certain limited circumstances, can be a viable debt settlement option.

In order to qualify for a Joint Consumer Proposal, ALL or SUBSTANTIALLY ALL of the assets and liabilities or debts of the couple must be THE SAME.

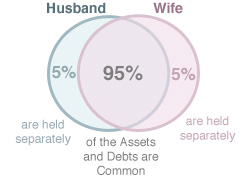

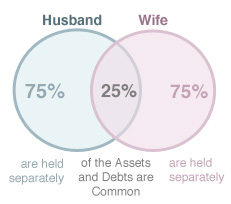

This situation, although rare, usually happens where only one person in the household is working, and their assets and liabilities are co-mingled. For illustrative purposes, we provide two diagrams, one where a joint filing may be appropriate and a second where a joint filing is clearly inappropriate.

A POSSIBLE JOINT CONSUMER PROPOSAL SCENARIO

Only 5% of the Couple’s Assets and Debts are held Separately

SEPARATE CONSUMER PROPOSALS REQUIRED

The majority of the Couple’s Assets and Debts are held Separately

WHAT ARE THE ADVANTAGES AND DISADVANTAGES?

The primary advantage of filing a joint consumer proposal is that all aspects of your debts are dealt with together and the costs associated with administering your proposal are reduced, allowing your creditors to receive a larger portion of your payments, which may act as an incentive for them to accept a proposal from you.

The principal disadvantage of filing a consumer proposal on a joint basis is that you are “crazy glued” to that person for the entire term of the proposal. If one person decides not to participate in the proposal or a couple decide to separate and there is a dispute between them, one person may be required to pick up the slack and make the full payment if one of the parties refuses to participate.

For example, if the monthly payment in your joint proposal is $800.00, you are jointly and severally liable for the payment, regardless as to what happens later. It is not that each person pays $400.00/month, and their payments are separate.

Not to try to discourage anyone from filing joint consumer proposals, but the most common scenario we see involves joint consumer proposals where a couple separates during the term of the proposal, and one of those individuals cannot or refuses to pay their share. In order to keep the proposal alive and prevent a bankruptcy, the other person will have to pay the whole thing by himself/herself.

As you can see, if there is any chance of marriage discourse, or the likelihood of the parties going separate ways, a joint consumer proposal is not likely your best option.